CEMA, the European association representing the agricultural machinery industry in Europe, has issued a statement saying that in line with expectations, 2016 demand for farm machinery in Europe is set to end up with a drop.

The outlook for 2017 does not look much better, with lower or at best stable demand expected for most agricultural machinery products.

Agricultural tractor sales in Europe in the first nine months of 2016 were 4.5% lower in comparison with the same period last year. However, the decline in Q3 was slowing down to -2,2% when compared to Q3 in 2015. Demand is particularly lower for mid-range tractors between 125hp and 250hp.

In the countries of the CEMA network*, only in Austria, Belgium and Spain more tractors were sold so far in 2016 than in 2015. All other countries where at best stable, as in the case of Italy. Tractor sales in France were up the first half of the year, but a sharp decline in Q3 will result in an overall decrease. The German market experienced a strong increase in Q3 after a weak start of 2016. Year-to-date sales in 2016 are only 2% lower than in 2015. Demand in Denmark and the Netherlands also fell further. It is expected by the economic experts of the CEMA member associations that the demand for tractors will remain at a similar and relatively low level in 2017.

One remarkable occurrence, say CEMA, is a peak in demand in September in the power category 56 kW to 130 kW (75 hp to 175 hp). They say this can be explained due to the end of certain transitional provisions as part of the EU’s exhaust emissions legislation. Many tractors with Stage IIIB engines needed to be registered before 1 October, as, otherwise, they would not be allowed to be registered anymore.

Demand for most other major agricultural machinery products declined in the CEMA countries as well in line with predictions. Combine harvester sales are expected to be down 13% in 2016, with drops observed in all CEMA countries. For 2017, the market will shrink further. Particularly in France, a significant reduction is expected.

The 2016 market for mowers experienced a further decline in 2016 of almost 10%. Only the Spanish market grew and the French and Italian market were stable. In 2017, this trend will continue with even lower demand.

A similar decrease of 10% is seen in the forage harvester market in 2016. Again, the Spanish market was the best performer. From the other countries only the Belgian market grew and the Italian market stabilised. It is expected that demand will stabilise in 2017 with only minor rates of growth or decline in the different CEMA markets.

The decrease for balers was rather limited at 2.4%. Demand in all countries was stable or weakened only marginally. A slightly higher decline is forecasted for 2017.

Sprayers were the only products where sales went up in 2016. An increase of 3.6% was mostly due to a large increase in Spain and to a lesser extent in Italy. Germany and the UK experienced significantly lower sales. The sprayer market probably won’t keep up this growth rate for 2017, mainly due to another high drop in demand expected in Germany.

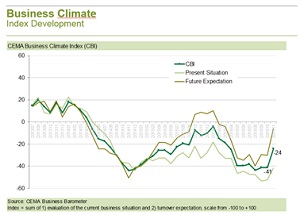

Even though the expectations for 2017 are not very positive, the CEMA Business Barometer is slowly recovering from its record low level (see graph below). This might be a sign, say CEMA, that further positive market developments could occur later in 2017.**

*The CEMA countries considered in this report are: Belgium, France, Germany, Italy, Netherlands, Spain and UK.

** As a monthly survey that is sent to the European agricultural machinery industry and covers all the major product categories, the CEMA Barometer provides a regular overview of the business mood based on current business sentiment and the expected turnover in the next 6 months.