CHRISTMAS CHEER OR HALLOWEEN HORROR?

Following last Tuesday’s budget

by Service Dealer Ireland Editor, Alan Mahon

How did the business community fare out, particularly small businesses, of which there are many in our industry?

Last Tuesday’s budget brought good news to most people in the country, especially PAYE workers and those on social welfare. But how did the business community fare out, particularly small businesses, of which there are many in our industry?

Here are some of the key changes that may impact our sector.

VAT changes: The existing VAT registration thresholds of €37,500 for services and €75,000 for goods will now be increased to €40,000 and €80,000 respectively. On the whole, this is seen as a welcome move. However, for our sector, it may not apply as many dealers are already over this threshold. It may be beneficial to those who are involved in repairs and service.

Minimum wage: The minimum wage is going to be increased from €11.30 to €12.70 per hour. This is a 12% increase and will put extra expense and pressure on small businesses who may have several of their staff on the minimum wage.

Cost of living support: Spiraling energy costs, rent and higher material and transport costs not only affect householders. Businesses are also prone to these extra costs when running a business. A €250 million package of temporary supports will be made available to businesses to help them through these challenges. Around 130,000 small and medium businesses will get up to half of their commercial rates back under this scheme.

Increase in carbon tax: From Oct 11th last fuel prices increased as a result of the increase in carbon tax. As already mentioned diesel, petrol and heating costs are already climbing, this makes running a business even more expensive. It will also put pressure on some of our professional customers such as farmers, growers, contractors and landscapers.

The minimum wage increase is probably the single biggest change made in the budget that could have serious knock on effects on small businesses, probably more than the other benefit gains combined. As well as the added expense to the employer, there may be other hidden costs from this increase in the minimum wage. For example, any employee who may have started on the minimum wage and are now on a higher rate because of their loyalty of service may feel a bit hard done by when they see new staff starting on a salary close to their own. It wouldn’t be surprising to see them ask for a pay increase. If they don’t get it, it could lead to low morale, with some staff possibly leaving to look for work elsewhere. Given that we are in full employment, getting in new staff could be a tough challenge. How many businesses can survive these wage increases remains to be seen. Only time will tell.

On the upside, the fact that the average householder will benefit by €1000 or more per year will allow for more disposable income. It will be interesting to see if some of this extra cash will spill into our showrooms.

How will Irish dealers and distributors view budget 2024? Will it be a cheerful Christmas or a Halloween of horrors?

|

|

|  |

BUSINESS CLIMATE IN RECESSION

For Euro dealers says report

Survey shows that the general business climate index for the agricultural machinery industry in Europe remains in negative territory showing little change compared to September.

The European Agricultural Machinery Association (CEMA) have published their monthly business survey for European dealers.

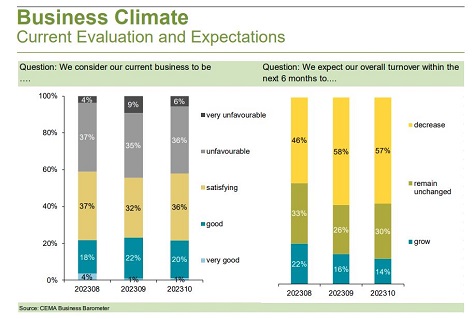

The survey shows that the general business climate index for the agricultural machinery industry in Europe remains in negative territory showing little change compared to September after the sharp declines of the previous months. In October, the index decreased from -31 point to -32 points (on a scale of -100 to +100).

The survey confirms once again that the direct customers of the manufacturers, the dealers, are not able to pass on their numerous orders to the end customers and have thus slid from undersupply to record-high oversupply. According to the survey, the dealer stocks are now in most European markets higher than in the year 2019, which went down in history due to high dealer stock levels.

Accordingly, there is not one single European market for which a majority of survey participants would have positive turnover expectations. The strongest declines are expected for the markets in Central and Eastern Europe. France remains ahead of Germany in the market ranking.

Only 20% of the survey participants give a good evaluation of the current business, nearly 60% expect their turnover to decline in the next six months and with a view to the coming order intake (an indicator which is not considered in the calculation of the overall barometer index) nearly 70% expect further declines.

CEMA questionnaire results from dealers on current evaluation and expectations

|  |

LISTEN TO SERVICE DEALER IRELAND OWNER ON B CORP JOURNEY

Features on new podcast

Duncan Murray-Clarke has been speaking to the Rural Business Focus podcast regarding The Ad Plain achieving B Corp certified status.

Service Dealer Ireland owner, Duncan Murrary-Clarke, has featured on a recent episode of the Rural Business Focus podcast, talking about The Ad Plain's journey to becoming B Corp certified.

Duncan Murray-Clarke

Duncan talks to the host, journalist Ben Eagle, about what B Corp is and what it means for the business. He explains the hard work, long process and expense of achieving the certification, but says, "Ultimately, having gone through the whole process, it has been thoroughly rewarding."

You can listen to the whole podcast here - and read more about TAP's B Corp certification here.

|

|  |

CNH CONFIRM HIGH-TECH INVESTMENT

Smart harvesting technologies

Manufacturer invests in start-up that specialises in the robotic harvesting of apples, strawberries and other fruits.

CNH have announced that they have continued to support the acceleration of smart harvesting technologies with a minority investment in the California-based start-up Advanced Farm Technologies, which specialises in the robotic harvesting of apples, strawberries and other fruits.

The two businesses say they will partner to drive industry and ecosystem innovation by collaborating across R&D and commercialisation.

CNH say shifting to robotic picking has great potential to significantly improve fruit farmers’ productivity by harvesting high value crops up to five times more efficiently. In the United States, 46% of the production cost of apples comes from handpicking labour, 70% in the case of strawberries. These high labour costs are exacerbated by a continued downward trend in handpicking workforce availability.

Advanced Farm Technologies’ system uses computer vision and a machine learning tech stack to pick the best fruit, either during the day or at night, while gently handling it to avoid bruising and damage. Their system’s robotic arms with gentle grippers, a serial-hybrid drive system, autonomous navigation and automated bin handling are among the key features. This automated platform eliminates the need to carry a ladder from tree to tree - vastly reducing the strain of a repetitive and arduous task.

CNH say they are in a technology growth mode, especially focused on automated, autonomous, and sustainable farming innovations.

|  |

AG ROBOTIC MINE DETECTOR A REALITY

Funding helped by Service Dealer Awards attendees

Safe Fields For Ukraine, the organisation supported by 2022's Service Dealer Awards, has successfully completed their de-mining system prototype.

Safe Fields For Ukraine, the organisation supported by 2022's Service Dealer Awards, has successfully completed their prototype for an agricultural land de-mining system.

Jonathan Elwes, one of the founders of the organisation, said, "It's very exciting news that the ‘Safe Fields’ team in Vinnyt’sia, Ukraine have successfully completed the prototype.

"This was achieved against unbelievable odds; Vinnyt’sia was at times being bombed indiscriminately. The team worked through a bitterly cold winter while their heating and power systems were often out of commission and at this stage drone warfare taking place right across the country which made field testing very difficult to arrange."

Originally their Robotic Mine Detector was designed within a standard small tractor. After extensive testing, the tractor evolved into a revolutionary new vehicle with ultra-low-pressure tyres which they named the Frendt Rover. It has a significantly reduced weight footprint.

Jonathan Elwes speaking at the 2022 Service Dealer Awards

Jonathan continued, "On 20 September 2023 the Frendt Rover was introduced at the Agro Vinnyt’sia Exhibition which triggered a huge immediate response with well over 100,000 social media hits. The Frendt Rover can identify explosive objects to a depth of 50cms in an area of up to 10,000 square metres in one hour, whereas a single sapper is typically able to survey only 25 to 100 square metres in a whole day.

"Frendt have concluded agreements with Swiss Humanitarian Demining Organisation (a similar organisation to HALO Trust) who plan to operate production versions of the Frendt Rover before winter."

Service Dealer owner, Duncan Murray-Clarke, said, "We are so pleased that this project has flourished despite all the hardships faced by the team. We were delighted with the generosity shown at last years’ Service Dealer Awards and it seems the funds have gone to a very important cause that will save many lives and help agriculture in Ukraine."

|  |

RYAN PRODUCTS TO SWITCH BRANDING

Change for 2024

Owners announce that Ryan turf renovation equipment will rebrand in 2024.

Doosan Bobcat has announced that its Ryan turf renovation equipment will rebrand as Bobcat in 2024.

Ryan equipment joined the Doosan Bobcat portfolio in 2020, following the acquisition of Bob-Cat Mowers and the Steiner and Ryan brands from Schiller Grounds Care. Ryan has produced turf renovation equipment for more than 75 years and features a product line-up including aerators, sod cutters, dethatchers, power rakes, overseeders and other speciality products that serve landscaping and groundscare professionals.

Bobcat say that following their success in new product lines such as mowers, compact tractors and grounds maintenance equipment, they have streamlined its branding approach to "strengthen overall brand equity, market recognition and consumer recall of all product offerings."

Earlier this year, Doosan Bobcat announced its Doosan Industrial Vehicle and Doosan Portable Power brands would transition into the Bobcat product portfolio in Europe, Middle East, Africa and applicable markets worldwide in 2024.

With this refreshed identity, Ryan products will undergo design and aesthetic changes in alignment with current Bobcat branding says the manufacturer. The turf renovation equipment is produced at the Doosan Bobcat manufacturing facility in Johnson Creek, Wisconsin, USA, and will continue to be manufactured there following the brand transition.

Bobcat-branded Ryan equipment is expected to be available for customer purchase through Doosan Bobcat’s global dealer network in 2024.

|  |

JCB SAYS OUTLOOK FOR NEXT YEAR "UNCERTAIN"

And announces profits for this year

JCB issues a statement against a backdrop of "supply chain disruption, high energy prices and rising levels of inflation."

JCB have announced that profits and turnover rose in 2022 but is warning of a less certain outlook for the coming year.

Sales turnover in 2022 grew to £5.7 billion (2021: £4.4 billion) and profit before tax grew to £557.7 million (2021: £501.6 million). Machine sales increased to 105,148 (2021: 95,650). The Group say they maintained a strong balance sheet with no net borrowings throughout 2022.

JCB CEO Graeme Macdonald issued a statement, saying “The Group delivered a strong set of results in 2022 against a backdrop of supply chain disruption, high energy prices and rising levels of inflation.

"The situation for the remainder of this year and into 2024 remains uncertain as some markets and certain sectors are showing early signs of softening.”

|

|  |

Sponsored Product Announcements

|

SHOWCASE YOUR NEW PRODUCTS HERE

Have your new equipment seen first!

Use this Ireland Weekly Update to showcase your new products to our ever-growing community of specialist dealers.

Contact Nikki Harrison - 44 01491 837117

|

ADVERTISE YOUR JOBS HERE

Amazing success rates!

Advertise your recruitment needs on Serivce Dealer Weekly Update Ireland and reach our targeted audience of recipients every week.

Contact Nikki Harrison for details - 44 01491 837117

|

|

|